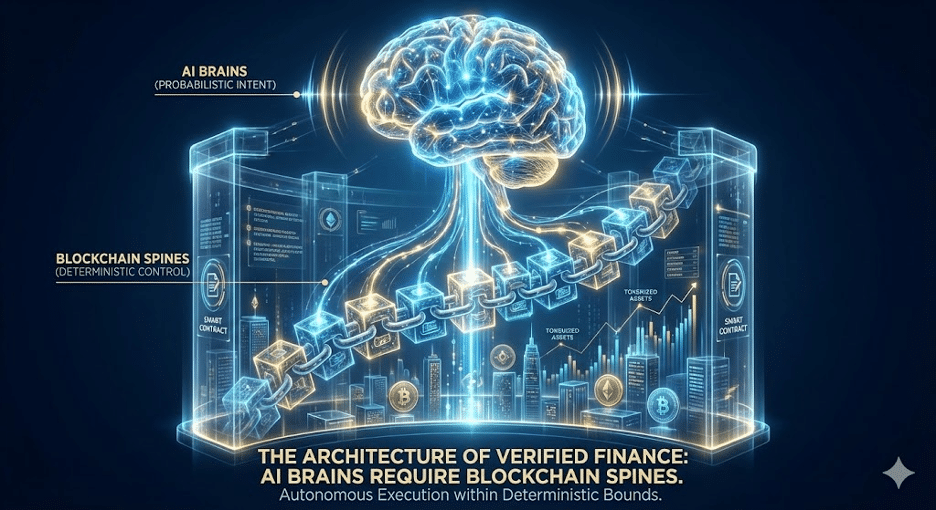

The Architecture of Verified Finance: Why AI Brains Require Blockchain Spines

This is not a story about blockchain or AI. It’s a finance story about two forces accelerating so quickly that boards are being forced to treat them as strategic risk and strategic opportunity at the same time. Blockchain is turning markets into code. AI is turning decision making into software. Each is moving on its own track, but they are not independent. Their intersection is inevitable, and when they connect, they will change how capital is allocated, governed, and moved.

Finance is moving on-chain. Tokenized funds, treasuries, private credit, and collateral are no longer pilots, they are becoming infrastructure. Tokenization is simply the representation of traditional financial instruments as digital assets that can be issued, held, and transferred on a blockchain. Stablecoin transfer volume is now measured in the tens of trillions annually, with 2024 estimates above $20T.

Larry Fink put it plainly: “We’re just at the beginning of the tokenization of all assets.” The implication is simple. Institutional finance is shifting from viewing on-chain assets as a product category to treating them as a core settlement layer.

Tokenization is not the destination. It is the foundation. The real shift begins when execution becomes autonomous.

Regulatory clarity is the catalyst

For years, adoption was held back by legal ambiguity. Institutions do not deploy serious capital into systems that might be reclassified or constrained after the fact. That’s what changed.

The GENIUS Act, enacted July 18, 2025, established a federal framework for payment stablecoins, including standards for reserves and issuer oversight.

In parallel, the Digital Asset Market CLARITY Act of 2025 is designed to reduce jurisdictional overlap between the SEC and CFTC and provide a clearer perimeter for digital commodity markets and intermediaries.

The takeaway is not legislative nuance. It’s speed. Predictable compliance makes capital mobile, and on-chain settlement compresses timelines from days to minutes. Once capital moves that quickly, governance cannot remain manual.

Boards should recognize what this unlocks. Market infrastructure is being rebuilt as software, and regulation is removing the friction that kept that shift from scaling.

AI is becoming the execution layer

While markets are being rebuilt as code, AI is becoming the operator. Not a chatbot, an executive. We are deploying systems that interpret intent, optimize allocations, and increasingly trigger transactions across tokenized markets.

The next phase is not just agents transacting into markets. It’s agents transacting with other agents. Negotiating liquidity, routing orders, coordinating execution, and operating at machine speed. Once execution becomes machine to machine, complexity and velocity move beyond human supervision. That is when controls have to be built into the transaction layer.

That creates a new problem: AI is probabilistic. It does not generate truth, it generates the most likely answer. Confident errors are not rare, they are structural. In finance, that is unacceptable.

If an AI agent misreads a signal, fabricates a source, or extrapolates from bad data, it can still produce a clean and persuasive decision that is wrong. When that agent has authority to move capital, the error becomes a loss event.

The Catastrophic Failure Scenario: Imagine an AI treasury agent that “hallucinates” a market flash crash based on corrupted sentiment data. Without a control layer, it could liquidate a billion-dollar position in milliseconds to “stop the loss.” However, with a blockchain spine, the smart contract blocks the trade because the on-chain price oracle does not corroborate the crash data. The code saves the capital when the brain creates a fiction.

This is where the trajectories meet. Tokenization makes money software-native. AI makes execution autonomous. These trends started independently, but the moment autonomous systems can touch software-native money, finance inherits a new governance problem.

AI will run ahead of your controls unless controls become part of the execution path.

Blockchain is the control plane

A smart contract is software deployed on a blockchain that executes exactly as written. It can hold assets, enforce permissions, and block actions that violate policy, without relying on human intervention. Smart contracts are deterministic. They do not interpret intent. They enforce rules. They also create an execution record that can be inspected, verified, and replayed.

That is exactly what AI lacks.

This is the tension in modern financial architecture:

- AI moves quickly, but without guarantees.

- Blockchains enforce outcomes, but without context.

AI can reason. Blockchains can prove. Verified finance requires both.

In this model, blockchain is not “the product.” It’s the control plane that makes machine execution safe.

Verified Finance: AI proposes, blockchain enforces

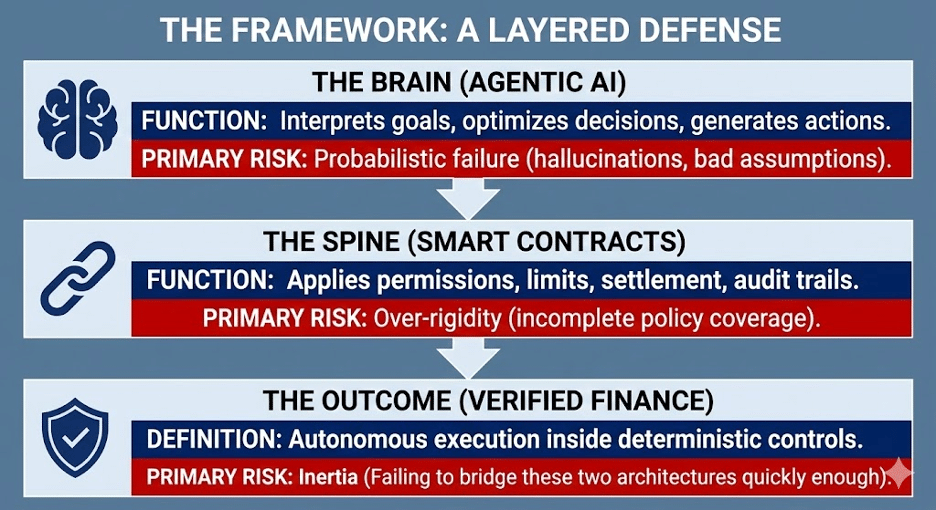

Verified finance is a design pattern for autonomous execution inside deterministic controls. It is not a philosophical stance, it is an operating model.

The pattern is simple:

- AI generates intent and action

Allocation decisions, trade instructions, portfolio rebalancing, liquidity routing, and agent-to-agent coordination. - Smart contracts apply policy at runtime

Permissions, limits, exposure caps, whitelists, approvals, separation of duties, and exception handling. - The chain produces proof

Immutable execution records, provenance, auditability, and replayable evidence.

Imagine an institutional agent tasked with optimizing treasury yield. It can scan on-chain pools in real time, but it cannot move funds freely. A smart contract can impose boundaries:

- interaction restricted to whitelisted protocols

- exposure caps per asset class

- liquidity and duration limits

- counterparty requirements

- separation of duties

- mandatory approvals for exceptions

The AI recommends. The contract decides.

That is the point. Governance becomes part of execution.

Governance has to operate at the system level

AI governance is the joint that connects the AI execution stack to the blockchain enforcement stack, and ensures both can be audited as one system. This is where many institutions will get it wrong. Governance cannot stop at the AI model. The new unit of risk is the Full Agentic Stack, spanning the AI system and the crypto rail’s smart contracts that settle the outcome.

Verified finance requires controls across:

- Models, capability, evaluation, change control

- Data, quality, provenance, drift, and access control

- Workflows, approvals, escalation paths, and overrides

- Decision engines, policy logic, constraints, and runtime guardrails

- Smart contracts, permissions, settlement logic, versioning, and auditability

- Monitoring, ongoing detection, alerts, and evidence generation

If any one layer is unmanaged, the system is unmanaged.

The institutional imperative

Boards, CROs, and CIOs should treat this as an architectural decision, not a tech experiment. Capital is moving on-chain. Execution is moving toward autonomous agents. Governance must shift from policy documents to runtime controls.

GENIUS creates stablecoin standards. CLARITY sets market structure direction. AI brings efficiency. Together, they compress the timeline for institutional adoption.

Here is what this looks like in practice. A treasury agent can rebalance across tokenized cash, bills, and on-chain liquidity venues in real time, but only within contract enforced constraints on duration, counterparties, and concentration. Another agent can negotiate collateral swaps with external agents, but settlement only occurs if risk, eligibility, and exposure limits are satisfied, and every step is logged as audit evidence. When exceptions occur, they route into human approval workflows, and the system can prove what happened, why it happened, and who authorized it.

The institutions that win will not be the ones that “adopt AI” or “adopt blockchain.” They will be the ones that design the interface between them, and govern the full system end to end. They will let autonomous systems move capital and transact with each other, but only inside provable, auditable bounds.

The future of finance is not blockchain. It is not AI. It is what happens when software-native markets meet autonomous execution, and when trust shifts from human process to mathematical control.